You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

Shawn Hultquist

WKR

XOM up 7.09% for the week thats good news. at least that makes up for the volatile NVDA i have. I know the tech struggles in the January lull ill just keep buying the dips.

F with the big 12% day good for them

F with the big 12% day good for them

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

SENS is up 27% after hours for me. I’m hoping this is a sign FDA is coming soon.

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Poser

WKR

SENS is up 27% after hours for me. I’m hoping this is a sign FDA is coming soon.

Sent from my iPhone using Tapatalk

Just checked mine

Looking good.

Poser

WKR

Who else is in on Ford? That stock sit dead, going joes here for months and not it’s poppin’ off.

Who else is in on Ford? That stock sit dead, going joes here for months and not it’s poppin’ off.

I wish I was. I remember watching it go just above $5 and I told myself I was going to buy the next dip into the $4’s…. Missed out for sure.

Sent from my iPad using Tapatalk

Congrats manHappy new year to everyone. Hopefully we can continue to help each other this year.

I ended the year a little over 100% in my IRA and 350% in my individual account that I use for risky short term plays. 2021 was my first whole year of playing in the stock market and I am glad to have made what I did.

Thank you all for your help and the information that has been shared. It has been awesome to see people be so willing to help. Coop, Broomd, OK and many others have shared so much information. Thank you.

I was able to put 2600 dollars in my IRA this week too. That’s the most I have been able to put in ever. I am super excited.

I can't help but feel like I shit the bed last year. I had a great year in 2020 to early 2021 but then kinda just bounced around all year. It's my own fault for not having discipline but I couldn't continually string winners.

My biggest learning this year is take profits on the bullshit and just hold the blue chips forever. I left so much money on the table not having conviction and selling off the tech, fintech, and blue chips too early for fear of the big recession. I need to cut losers early and hold the winners to valhalla.

Broomd

WKR

Hang in there, ND!...still plenty of time to be Valhalla's ambassador of Kwan.Congrats man

I can't help but feel like I shit the bed last year. I had a great year in 2020 to early 2021 but then kinda just bounced around all year. It's my own fault for not having discipline but I couldn't continually string winners.

My biggest learning this year is take profits on the bullshit and just hold the blue chips forever. I left so much money on the table not having conviction and selling off the tech, fintech, and blue chips too early for fear of the big recession. I need to cut losers early and hold the winners to valhalla.

Many of us can relate to the frustration. Like Oak and others I tax harvested and dumped 10K+ worth of OTC red ink last week. That sucked. Could have done much more too, but will continue to hold some.

MM's lost huge with WSB, that crazy Jan OTC run and subsequent collapse was their doing, I'm certain of it.

Will we get another OTC run this early '22 like we did in '21 to clean up some stragglers?.. hope springs eternal.

Huge crude draw this week, builds elsewhere.

API:

Crude -6.432M

Gasoline +7.061M

Cushing +2.268M

Distillate +4.340M

Last edited:

rickjames80

WKR

- Joined

- Jun 12, 2013

- Messages

- 677

SENS is up 27% after hours for me. I’m hoping this is a sign FDA is coming soon.

Sent from my iPhone using Tapatalk

Senseonics Announces Business Updates

Senseonics Holdings, Inc. (NYSE American: SENS), a medical technology company focused on the development and manufacturing of long-term, implantable c

www.businesswire.com

Crowmangler

WKR

Preach...My biggest learning this year is take profits on the bullshit and just hold the blue chips forever. I left so much money on the table not having conviction and selling off the tech, fintech, and blue chips too early for fear of the big recession. I need to cut losers early and hold the winners to valhalla.

Doubled my $ in 6 months with TSLA & sold at $700... I shouldn't be disappointed with that but damn...I left a model S Plaid on the table

#1 thing I'll do is have a short fuse & a quick sell limit on the ones I don't have a lot of conviction for. No more letting my pride ride them off the cliff like Thelma & Louise.

#2 ...Pay attention even when too busy to pay attention....I missed out big time with RKT when the WSB crowd ran it up 75% overnight then it came right back down.

NorthernMN

FNG

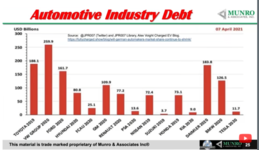

A lot of the legacy auto manufactures are sitting on mountains of debt. Ford will have to do more that sell the Mach E and F150 Lightening. They will have to make money on them. They have tons of legacy costs that they will not easily escape. Ford was issuing debt at near 10% just some months ago. In the short term they are benefitting from EV mania as is GM. Long term may be a very different story. Due your own research.Who else is in on Ford? That stock sit dead, going joes here for months and not it’s poppin’ off.

DenverCountryBoy

WKR

- Joined

- Jun 17, 2017

- Messages

- 1,229

From March 6, 2020Who else is in on Ford? That stock sit dead, going joes here for months and not it’s poppin’ off.

Still holding from 6/22/2020... Ford is looking attractive. Restructuring is winding down, several new models this fall including hybrid trucks and suvs.

...

Yesterday I picked up SHLL.WS, and doubled down on F, and CDEV. Going long term on all.

Average $7/share. Enough gains to pay for the F150 hybrid I ordered last month.

BeaverHunter

WKR

- Joined

- Sep 15, 2018

- Messages

- 973

I’m glad you mentioned this. I work at an auto group with a couple Ford dealerships. Ford is really good at screwing things up and not making money. If you saw how many parts they have on back order for broken down cars/trucks(most that are under warranty) it would blow your mind. No way to get any kind of answer on parts and new car inventory issues and zero give a shit about how it affects the customer. I do think their new ceo has them doing better but it’s still a cluster **** and very disorganized company overall. How they have the brand loyalty they have is mind blowing to me. And I’m not taking shots at their quality, just how they’re ran.A lot of the legacy auto manufactures are sitting on mountains of debt. Ford will have to do more that sell the Mach E and F150 Lightening. They will have to make money on them. They have tons of legacy costs that they will not easily escape. Ford was issuing debt at near 10% just some months ago. In the short term they are benefitting from EV mania as is GM. Long term may be a very different story. Due your own research.

View attachment 364031

I do think their stock will keep riding this wave that all auto manufacturers are riding for awhile longer(6 months or so) but no way I’d want to own them long term. Not a well run company. Night and day difference between them and our Honda/Toyota stores relationship with the manufacturers. Especially our Toyota stores. Toyota has tons of new inventory coming to dealers and is past the worst of the chip shortage. And just an FYI I’m not a Toyota super fan at all. Just what I’m seeing. 20 years at the same dealership/auto group as a used car manager. Just my 2 cents so take it for what it’s worth.

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 6,768

Nicely done.From March 6, 2020

Still holding from 6/22/2020

Average $7/share. Enough gains to pay for the F150 hybrid I ordered last month.

Poser

WKR

From March 6, 2020

Still holding from 6/22/2020

Average $7/share. Enough gains to pay for the F150 hybrid I ordered last month.

just like in 2009 when it dropped below $2. I sold mine last year at $14. Should have heldFrom March 6, 2020

Still holding from 6/22/2020

Average $7/share. Enough gains to pay for the F150 hybrid I ordered last month.

Good move

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

Rough day.

Cryptos getting kicked also.

Sent from my iPhone using Tapatalk

Cryptos getting kicked also.

Sent from my iPhone using Tapatalk

Poser

WKR

Rough day.

Cryptos getting kicked also.

Sent from my iPhone using Tapatalk

Definitely took a nosedive this afternoon. I bought some more MaNA, SaND and ETH, though.

ETtikka

WKR

That 2:00 fed horsecrap hurt bad today

Poser

WKR

That 2:00 fed horsecrap hurt bad today

Will be interesting to see if we pull out of this tomorrow or if it stays red through Friday. This whole addressing inflation is going to cause some pain, I’m afraid, especially in the tech stock sector.

Similar threads

- Replies

- 1K

- Views

- 78K

Featured Video

Stats

Latest Articles

-

Gunnison Mule Deer and Beyond with Brandon Diamond

-

Idaho Mule Deer Management with Eric Freeman

-

TT#28 Idaho Bear Hunting with Roger Holscher and Chris Young

-

Rockstar Research with Kevin Monteith

-

Hunting Big Mule Deer: Obey the Wind & Still-Hunting

-

TT#27 DIY New Zealand Hunting with Australian Duo Miller and Pitts

-

Fewer Bucks, More Fawns?

-

Mathews Lift Review

-

Wyoming Range Winter Wrap-Up with Jeff Short

-

The Pursuit with Cliff Gray