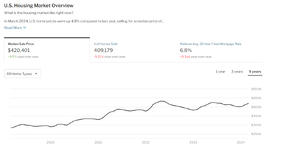

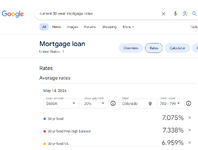

Id wager with the way housing prices are going it wont be an issue for 10 years.... an appraisal is a small cost compared to the interest paid.Partially true - the pmi is based on the loan to value ratio and will go away once you hit the 80/20. That’s based on the original value so you’d have to pay for a new appraisal if you want the new value reflected (and it has to be an appraisal through someone the bank approves). If you have a 30 year mortgage and pay it that way you barely touch principal the first 7-10 years so PMI will stick around a while.

My point was to not let PMI scare people off from buying in now.