You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

Badseed

WKR

- Joined

- Jul 10, 2020

- Messages

- 471

Does anyone have a general rule about when you look to average down your cost. Say you wait for at least a 5% drop or something?

By no means am I a financial guru or even close to it but many people smarter than me answer your question by asking you to answer these questions:

Is this a short or long term investment?

If long term, how much do you understand the company your are investing in and how confident are you that the price will rebound?

If short term, how much of gain do you need on another investment to recoup your losses? Basically, the more you lose, the more you need to recoup on your next investments to break even.

For example, if you invest $100 and the price drops 5%. You sell and are left with $95 to invest. With tour next $95 investment, you need to make a 5.3% to get back to your initial $100 which is highly probable. This calculation compounds quickly as you losses increase.

Next example, if your $100 investment looses 15%. Your next $85 investment will need a gain of roughly 18% to break even. This is a tougher task in the short term.

Sent from my iPhone using Tapatalk

Broomd

WKR

Dividends for those of us who are in the REITS.

GPMT declared a quarterly cash dividend of $0.25 per share of common stock for the first quarter of 2021. This dividend will be payable on April 19, '21 to common stockholders of record as of April 1, '21.

NYMT:

GPMT declared a quarterly cash dividend of $0.25 per share of common stock for the first quarter of 2021. This dividend will be payable on April 19, '21 to common stockholders of record as of April 1, '21.

NYMT:

| Declared | Ex-Date | Record | Payable | Amount | |

|---|---|---|---|---|---|

| Mar 15, 2021 | Mar 24, 2021 | Mar 25, 2021 | Apr 26, 2021 | 0.10 | U.S. Currency |

Last edited:

Broomd

WKR

Holding 36,500 GTE @ .52, I'd like to hold 50K, I'm going to work at it as cash allows.Youd be RAKING it in double with that many shares. Did you say you have 50k?

You could sell 500 covered calls with that many shares 4/16 $1 strike calls are .05 you could make $2500 on premium alone. If they hit you could more than likely wheel it and collect premium the other direction too until you picked the shares back up or collected premium non stop on selling puts.

I've got my hands full as it is with just equities and my TD acct.

THAT IS TOO FING TRUEKinda true

Sent from my SM-G960U using Tapatalk

Broomd

WKR

Badseed

WKR

- Joined

- Jul 10, 2020

- Messages

- 471

Where do you guys think AABB is headed? I’ve had a little for awhile but still not really sure about any of this crypto stuff...

I got in small a few weeks back because I like the concept. Since then, I have done more research and and added to my small investment. I really like the concept plus the company seems to be doing everything right and is methodical about it. Now that the tokens are live I expect to see a spike Monday when people learn about it and jump in with fomo. The question is what happens when it hits the 50 cent mark which is basically the resistance point so far.

Sent from my iPhone using Tapatalk

Johnboy

WKR

- Joined

- Dec 12, 2014

- Messages

- 539

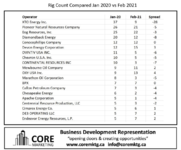

I just searched this thread for DVN (Devon Energy Corporation) and see that I asked about this one back on 4/19/20. My money would be x3 now if I'd bought and held. They're one of the few that added rigs. Hindsight, ya know?

Ive been in and out of DVN twice, like CPE, AXAS, CDEV, SM, GTE.... If I only held from last April. too instead of chasing the new hot sectors.... Hindsight and all that lol. Guess we'ill have to wait another 10 years or most likely longer for another opportunity like last MarchI just searched this thread for DVN (Devon Energy Corporation) and see that I asked about this one back on 4/19/20. My money would be x3 now if I'd bought and held. They're one of the few that added rigs. Hindsight, ya know?

Broomd

WKR

Long-Term Capital Gains Rates

After the passage of the Tax Cuts and Jobs Act (TCJA), the tax treatment of long-term capital gains changed. Prior to 2018, the tax brackets for long-term capital gains were closely aligned with income tax brackets. TCJA created unique tax brackets for long-term capital gains tax. These numbers generally change from year to year.| Tax Rates for Long-Term Capital Gains 2020 | |||

|---|---|---|---|

| Filing Status | 0% rate | 15% rate | 20% rate |

| Single | Up to $40,000 | $40,000 to to $441,450 | Over $441,450 |

| Head of household | Up to $53,600 | $53,600 to $469,050 | Over $469,050 |

| Married filing jointly | Up to $80,000 | $80,000 to $496,600 | Over $496,600 |

| Married filing separately | Up to $40,000 | $40,000 to $248,300 | Over $248,300 |

Source: Internal Revenue Service.6

Short-Term Capital Gains Tax Rates

Short-term capital gains are taxed as though they are ordinary income. Any income you receive from investments you held for less than a year must be included in your taxable income for that year.2

For example, if you have $80,000 in taxable income from your salary and $10,000 from short-term investments, your total taxable income is $90,000

The tax you'll pay on short-term capital gains follows the same tax brackets as ordinary income.

| Tax Rates for Short-Term Capital Gains 2020 | |||||||

|---|---|---|---|---|---|---|---|

| Filing Status | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

| Single | Up to $9,875 | $9,876 to $40,125 | $40,126 to $85,525 | $85,526 to $163,300 | $163,301 to $207,350 | $ 207,351 to $518,400 | Over $518,400 |

| Head of household | Up to $14,100 | $14,101 to $53,700 | $53,701 to $85,500 | $85,501 to $163,300 | $163,301 to $207,350 | $207,351 to $518,400 | Over $518,400 |

| Married filing jointly | Up to $19,750 | $19,751 to $80,250 | $80,251 to $171,050 | $171, 051 to $326,600 | $326,601 to $414,700 | $414,701 to $622,050 | Over $622,050 |

| Married filing separately | Up to $9,875 | $9,876 to $40,125 | $40,126 to $85,525 | $85,526 to $163,300 | $163,301 to $207,350 | $207,351 to $311,025 | Over $311,025 |

Source: Internal Revenue Service.7

:max_bytes(150000):strip_icc()/459045601-5bfc38f6c9e77c00519e638d.jpg)

Long-Term vs. Short-Term Capital Gains

Understanding the difference between long- and short-term capital gains ensures that the benefits of your investment portfolio outweigh the tax costs.

Crowmangler

WKR

Bought a chunk on 2-17 for $0.25 then sold on that bloody Tuesday (2-23) for $0.32 ... In hindsight I regret selling it but hard to complain about a 28% return in a week.Where do you guys think AABB is headed? I’ve had a little for awhile but still not really sure about any of this crypto stuff...

Personally I think it's a good concept also but I see them as one of many peripheral plays on crypto. Probably just as good / or bad as any of the others. It's so early any one of them could be a golden ticket.

I've been researching crypto a lot since then. Opened a couple accounts & just started buying individual ones directly. There are some that have 5x - 10x + just since March 1. (not any that I bought)

Instead of watching the bull why not just jump on & ride it? It's not for the faint of heart lol,

Broomd

WKR

TSNPD slooowly coming to life, name change Friday to HMBL, app dropping soon--global player--should be a great week! FORW will catch up too.

Luckin killin' it -- 5-6 days ago $5.80, right now $11+ ....a dark horse for crazy money on minimal shares over the next 4-5 months.

Luckin killin' it -- 5-6 days ago $5.80, right now $11+ ....a dark horse for crazy money on minimal shares over the next 4-5 months.

back country

WKR

- Joined

- Jan 10, 2014

- Messages

- 613

Holding 5k shares of TSNPD long term

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

go_deep

WKR

- Joined

- Jan 7, 2021

- Messages

- 1,647

Bought more BORR and RIG today.

mattyd23

FNG

- Joined

- Mar 22, 2021

- Messages

- 8

Yup, travel is still far from their pre-pandemic levels. Probably still a good buy.

go_deep

WKR

- Joined

- Jan 7, 2021

- Messages

- 1,647

Thought I got some good deals yesterday on some oil stocks, guess I was wrong. Oil stocks are on sale big time in premarket right now. Not sure if they're done dropping thought.

MuleyFever

WKR

Broomd

WKR

I've sold a few EV/btc-stock plays; hated to do it, but won't let some of these OG prices go without adding.

I won't sit in margin.

Grabbed some GTE - up to 40K shares now.

Added some HLX and some BORR.

I won't sit in margin.

Grabbed some GTE - up to 40K shares now.

Added some HLX and some BORR.

Similar threads

- Replies

- 1K

- Views

- 78K

Featured Video

Stats

Latest Articles

-

Gunnison Mule Deer and Beyond with Brandon Diamond

-

Idaho Mule Deer Management with Eric Freeman

-

TT#28 Idaho Bear Hunting with Roger Holscher and Chris Young

-

Rockstar Research with Kevin Monteith

-

Hunting Big Mule Deer: Obey the Wind & Still-Hunting

-

TT#27 DIY New Zealand Hunting with Australian Duo Miller and Pitts

-

Fewer Bucks, More Fawns?

-

Mathews Lift Review

-

Wyoming Range Winter Wrap-Up with Jeff Short

-

The Pursuit with Cliff Gray