I used robinhood to do crypto, still use it a bit.I personally would put what you’re willing to lose into your e trade account to learn how the market works. I would put the rest with an investor until your comfortable managing it yourself.

Once you learn the market is rigged against you, you may go 100% crypto.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

jbosk15808

Lil-Rokslider

Have you looked into if you qualify in setting up a roth ira? This way at least $6k of the money you invest each year can grow tax free. This may be something to consider when selecting a brokerage but depends on your financial goals and stuffOk smarter than me folks, if I wanted to invest 5 k every other month who should I look at going through?

Just set it up with my employer finance office last week.Have you looked into if you qualify in setting up a roth ira? This way at least $6k of the money you invest each year can grow tax free. This may be something to consider when selecting a brokerage but depends on your financial goals and stuff

Paradox

FNG

- Joined

- Oct 30, 2021

- Messages

- 66

Couple points….

1 do not waste your money on an advisor. Pick an index fund you can live with (s&p 500)

and keep putting money in

2 just got a letter from vanguard, says they will charge $20 a year to get paper statements. If that matters to you. I am in the process of moving all my vanguard funds to Schwab.

if you have a investment plan at work, contribute enough to get the match, then you can also contribute to a personal IRA, depending on your income, either after tax IRA or ROTH. I learned after the fact the limit for married filing separate is just $10,000!

1 do not waste your money on an advisor. Pick an index fund you can live with (s&p 500)

and keep putting money in

2 just got a letter from vanguard, says they will charge $20 a year to get paper statements. If that matters to you. I am in the process of moving all my vanguard funds to Schwab.

if you have a investment plan at work, contribute enough to get the match, then you can also contribute to a personal IRA, depending on your income, either after tax IRA or ROTH. I learned after the fact the limit for married filing separate is just $10,000!

JVS

Lil-Rokslider

- Joined

- May 30, 2021

- Messages

- 165

I agree with Paradox in doing the bulk of investing on your own.. Its well worth the time to learn. The advisors will put you in mutual funds with higher fees because thats how they make their money. Stick with index funds. The fees are generally lower. Vadgaurd has some great funds with crazy low fees. I put most of my money in VUG "vangaurd ultra growth" ETF. Its expense ratio is .04%. So if you invested 10K it cost you $40 a year. Well worth it to be invested in a basket of over 200 stocks. I still buy individual stocks but have gotten burned several times doing so. Paypal really stung me. But my tesla purchase 4 years ago was a home run and literally changed my life from a financial stand point. In this market I have really enjoyed dividend investing. My favorite fund is JEPI. Super low expense ratio and pays approx 10% annual dividend on a monthly basis. So say you had 100k worth it will pay you approx 833+ a month. Its been fun to reinvest the dividends and keep it growing. The only down side to these type funds is your on the hook for the taxes on some of the dividend that doesn't qualify for being tax deferred. I could go on an on. I love this stuff

Kimber7man

WKR

You know you can save $20 and get electronic statements for free from Vanguard and just print them out yourself?Couple points….

1 do not waste your money on an advisor. Pick an index fund you can live with (s&p 500)

and keep putting money in

2 just got a letter from vanguard, says they will charge $20 a year to get paper statements. If that matters to you. I am in the process of moving all my vanguard funds to Schwab.

if you have a investment plan at work, contribute enough to get the match, then you can also contribute to a personal IRA, depending on your income, either after tax IRA or ROTH. I learned after the fact the limit for married filing separate is just $10,000!

Paradox

FNG

- Joined

- Oct 30, 2021

- Messages

- 66

Yeah I know that but it’s the principle and I don’t have the time or inclination to look them up and print them out! Besides i can own the same funds in my Schwab account.You know you can save $20 and get electronic statements for free from Vanguard and just print them out yourself?

Ok smarter than me folks, if I wanted to invest 5 k every other month who should I look at going through?

Go spend some time reading here:

Whole market index’s are a good starting point as others have stated.

Thank you guys.Go spend some time reading here:

Whole market index’s are a good starting point as others have stated.

aftriathlete

WKR

- Joined

- Jan 18, 2022

- Messages

- 417

Lots of interesting action the last couple days, what's everyones' take? Jerome Powell reiterates Fed commitment to rate hikes, odds of .75% hike in two weeks now 100%, but the market is still up on the day. Weird stuff, although I saw an article on ZH that implied it was up yesterday and today just because of a short squeeze. Oil kinda hovering/maintaining where it's at right now despite MASSIVE SPR releases to try to keep gas prices down going into midterm elections, so what's OPEC to do when they already said they're willing to take action if the lunacy doesn't stop.

An interesting sequence of events for RECAF in the last couple weeks. Cleared up rumor of illegal drilling, hired someone with experience uplisting, announced reaching total depth of 8-2 well, and announced hiring of 2 firms to facilitate opening data room and JV negotiations.

The 8-2 well is the third drilled in a virgin basin in Namibia and the first targeting a seismically defined trap. We don’t yet know the results from this well, but RECAF has certainly laid the groundwork for announcing a discovery and attracting big money. It would also be timely for accelerating warrants before the October deadline. Lots of speculating here, but there are a few breadcrumbs. Boom or bust play. Should find out which by EOY.

The 8-2 well is the third drilled in a virgin basin in Namibia and the first targeting a seismically defined trap. We don’t yet know the results from this well, but RECAF has certainly laid the groundwork for announcing a discovery and attracting big money. It would also be timely for accelerating warrants before the October deadline. Lots of speculating here, but there are a few breadcrumbs. Boom or bust play. Should find out which by EOY.

HuntandFly

FNG

- Joined

- Aug 10, 2018

- Messages

- 94

The market has proven in the past, but especially recently, that it doesn’t need to make any sense short term to still succumb to a longer term trend up or down. The recent bear market rally seemed to be running on the fumes of a supposed dovish fed pivot sometime middle of next year. I and many others think that thought process is delusional.Lots of interesting action the last couple days, what's everyones' take? Jerome Powell reiterates Fed commitment to rate hikes, odds of .75% hike in two weeks now 100%, but the market is still up on the day. Weird stuff, although I saw an article on ZH that implied it was up yesterday and today just because of a short squeeze. Oil kinda hovering/maintaining where it's at right now despite MASSIVE SPR releases to try to keep gas prices down going into midterm elections, so what's OPEC to do when they already said they're willing to take action if the lunacy doesn't stop.

My long positions have been battered probably similar to everyone else’s but I did manage to get lucky on timing by opening a short position just before the Jackson hole speech as a hedge. I believe short to mid term pressure will continue downwards, no idea exactly where it stops

slick

WKR

- Joined

- Feb 13, 2014

- Messages

- 1,798

Man that’s another language^

So you think it’ll go up or down? $RECAF

So you think it’ll go up or down? $RECAF

They’re an oil exploration company. If they prove conventional resources, share price will go up. If they don’t, share price will go down. It is a high risk / high reward play.Man that’s another language^

So you think it’ll go up or down? $RECAF

aftriathlete

WKR

- Joined

- Jan 18, 2022

- Messages

- 417

Almost jumped in on some NASDAQ or S&P 500 bear ETFs today, but holding off considering NASDAQ doesn't really have resistance til about 12600, so it could easily run back up that high in this squeeze. S&P 500 is closer to resistance at about 4100, but hard to say if this squeeze is over. Who knows. I think a bear ETF will probably be my next buy though, next week maybe.

Old_Navy

Lil-Rokslider

Any one interested in conspiracy theories, or just a WTF moment.

Check out the sticker for DGCIX { Delaware Corporate Bond Fund }

it went from $5.12 to $15.40 in one day. In the past 5 yrs. it barley broke above 6 bucks. I sent off an email to my broker guy to sell all of it

on Monday before the rest of the world wises up. At first I thought

it was just a computer glitch, but the price held after the midnight

rollover at LPL and this am the NASDAQ still shows the price at

15.40

Check out the sticker for DGCIX { Delaware Corporate Bond Fund }

it went from $5.12 to $15.40 in one day. In the past 5 yrs. it barley broke above 6 bucks. I sent off an email to my broker guy to sell all of it

on Monday before the rest of the world wises up. At first I thought

it was just a computer glitch, but the price held after the midnight

rollover at LPL and this am the NASDAQ still shows the price at

15.40

Broomd

WKR

Hopefully your broker (or the pre-market) doesn't screw you.Any one interested in conspiracy theories, or just a WTF moment.

Check out the sticker for DGCIX { Delaware Corporate Bond Fund }

it went from $5.12 to $15.40 in one day. In the past 5 yrs. it barley broke above 6 bucks. I sent off an email to my broker guy to sell all of it

on Monday before the rest of the world wises up. At first I thought

it was just a computer glitch, but the price held after the midnight

rollover at LPL and this am the NASDAQ still shows the price at

15.40

I would want complete control of my acct for this very reason.

Last edited:

HuntandFly

FNG

- Joined

- Aug 10, 2018

- Messages

- 94

Yeah no using of a broker here, but I also probably deal in smaller trades than most folks.

Something weird going on for a corporate bond to jump 200% in a day like that.

Something weird going on for a corporate bond to jump 200% in a day like that.

I'm being a bit of a smartazz here, but my guess is that what you meant by your CT comment, but if I hear "Delaware," and a hint of something sketchy and involving money, then it almost certainly means the First Family in involved in some way.Any one interested in conspiracy theories, or just a WTF moment.

Check out the sticker for DGCIX { Delaware Corporate Bond Fund }

it went from $5.12 to $15.40 in one day. In the past 5 yrs. it barley broke above 6 bucks. I sent off an email to my broker guy to sell all of it

on Monday before the rest of the world wises up. At first I thought

it was just a computer glitch, but the price held after the midnight

rollover at LPL and this am the NASDAQ still shows the price at

15.40

Eddie

P.S. Good on ya for that nice little score and I agree on the sell order. You'll never go broke taking a profit.

Broomd

WKR

Been fairly ambivalent about our beloved CDEV/PR over the last few months, something about seeing a stock on your sheet killing it with value only to get battered during a literal global oil and energy crisis...the irony.

That said, she's been steadily muscling back.

Permian Resources PR ringing the opening NYSE bell this morning, so long NASDAQ!

In other news:

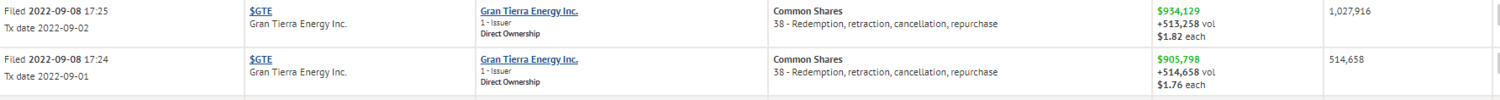

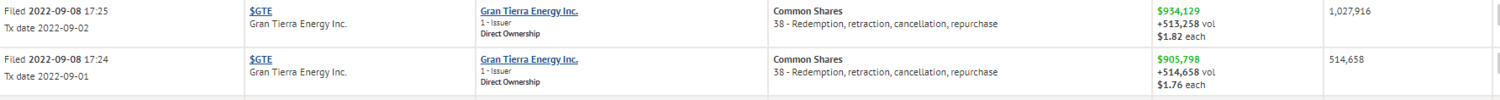

Buybacks started at GTE, the Canadian market limits to 10% of public float, but we'll take it.

That said, she's been steadily muscling back.

Permian Resources PR ringing the opening NYSE bell this morning, so long NASDAQ!

In other news:

Buybacks started at GTE, the Canadian market limits to 10% of public float, but we'll take it.

Last edited:

Similar threads

- Replies

- 1K

- Views

- 78K

Latest posts

-

-

Kill your dog and your political career at the same time

- Latest: Crowmangler

-

-

-

Featured Video

Stats

Latest Articles

-

Gunnison Mule Deer and Beyond with Brandon Diamond

-

Idaho Mule Deer Management with Eric Freeman

-

TT#28 Idaho Bear Hunting with Roger Holscher and Chris Young

-

Rockstar Research with Kevin Monteith

-

Hunting Big Mule Deer: Obey the Wind & Still-Hunting

-

TT#27 DIY New Zealand Hunting with Australian Duo Miller and Pitts

-

Fewer Bucks, More Fawns?

-

Mathews Lift Review

-

Wyoming Range Winter Wrap-Up with Jeff Short

-

The Pursuit with Cliff Gray