aftriathlete

WKR

- Joined

- Jan 18, 2022

- Messages

- 417

Before anything else, kudos again to all in the PR trade. My bet back at $8.50 didn't pay out as well as waiting would have.

Now my question is, anyone pay attention to I Bonds really understand why all the news stories are saying the expected rate announced on 1 Nov is going to be 6.48%? The interest rate is supposed to be a direct reflection of the CPI-Urban non-adjusted, which the last published for September was 8.2%. I don't think they'll have the October CPI-U by the time they announce the new rate on 1 Nov, so why wouldn't the rate be 8.2%? There must be something I'm missing, or something that's hidden, but it even explains on the Treasury Website how they calculate the interest rate and it's just the CPI-U plus the fixed rate that has been zero for a while now.

Edit: Just found this explanation at the link below. So I guess 8.2% YoY number is not what matters, it's the relative change from the index number 6 months ago. Which of course the Sept number was down due to the SPR releases and the decreased energy costs, but the price of energy going back up this month won't be captured. Guess that will be a good tailwind for the next 6 month period that will begin calculating with the October number.

tipswatch.com

tipswatch.com

Now my question is, anyone pay attention to I Bonds really understand why all the news stories are saying the expected rate announced on 1 Nov is going to be 6.48%? The interest rate is supposed to be a direct reflection of the CPI-Urban non-adjusted, which the last published for September was 8.2%. I don't think they'll have the October CPI-U by the time they announce the new rate on 1 Nov, so why wouldn't the rate be 8.2%? There must be something I'm missing, or something that's hidden, but it even explains on the Treasury Website how they calculate the interest rate and it's just the CPI-U plus the fixed rate that has been zero for a while now.

Edit: Just found this explanation at the link below. So I guess 8.2% YoY number is not what matters, it's the relative change from the index number 6 months ago. Which of course the Sept number was down due to the SPR releases and the decreased energy costs, but the price of energy going back up this month won't be captured. Guess that will be a good tailwind for the next 6 month period that will begin calculating with the October number.

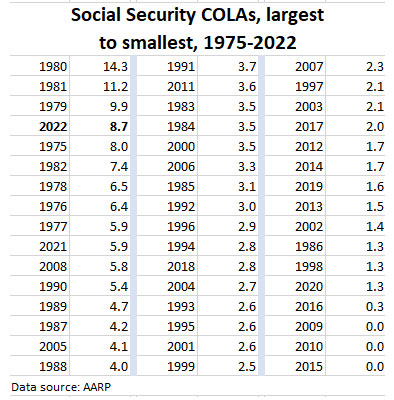

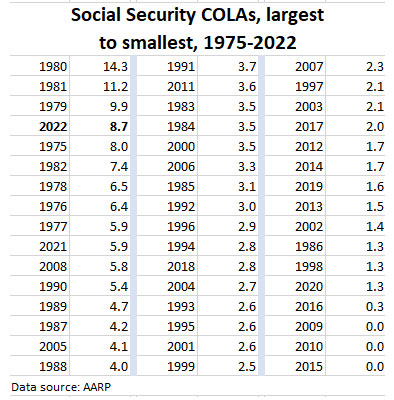

September inflation report sets I Bond variable rate at 6.48%; Social Security COLA rises to 8.7%

Annual core inflation hits 6.6%, a 40-year high. This isn’t good news for financial markets. By David Enna, Tipswatch.com Here is it, the most important Inflation Day of the year, setting in …

Last edited: