You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

Fowl Play

WKR

- Joined

- Oct 1, 2016

- Messages

- 485

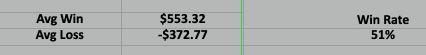

Copy, so I’m assuming you have some sort of automated stop loss built in to your trades to ensure the damage is small? But then have it exit your trade once a certain percentage profit is reached (or something similar). So things may only work out in your favor 50% of the time but automated filtering basically saves it.Say your average winner is $100 a contract but your average loser is only $50 a contract. That makes for an average of $25 profit per contract. 5 winners at $100=$500 minus 5 losers at $50=$250. Together you made $250 for the 10 trades or $25 expectancy per trade.

Or even 25% win rate but your winners are 5x the loser. Lose 3 at $100 but then win 1 at $500 for a $200 net or $50 per trade expectancy. Both of those are absolutely possible trading scenarios.

Marshfly

WKR

Stop losses are key. You can't trade without defining risk before you enter. You can ride profits but risk must be 100% defined before entry. That's that part about learning to lose. The market doesn't care where you entered or what you want. It's going where it's going to go. If you are wrong, you want to be wrong fast and small. That's all part of the probabilities of the trade which you know in advance because of your backtesting. Trading without backtesting and without defining risk and sticking to your stops is gambling. As an aside, most investing is gambling that the market goes up overall over time. Thankfully, due to inflation and an expanding economy, that happens for the most part and people don't get wrecked long term.Copy, so I’m assuming you have some sort of automated stop loss built in to your trades to ensure the damage is small? But then have it exit your trade once a certain percentage profit is reached (or something similar). So things may only work out in your favor 50% of the time but automated filtering basically saves it.

Most of my trades are selling options. So I am looking for them to expire worthless. That's my 100% profit target.

Marshfly

WKR

All real trading platforms allow you to enter stops on positions. All of them. A trade is entered when the price of the underlying hits a certain point. That's a stop. It's used to save your capital for the future. Like a circuit breaker.Copy, so I’m assuming you have some sort of automated stop loss built in to your trades to ensure the damage is small? But then have it exit your trade once a certain percentage profit is reached (or something similar). So things may only work out in your favor 50% of the time but automated filtering basically saves it.

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

Btc moving

Rumor is Black Rock is starting to accumulate for etf.

Sent from my iPhone using Tapatalk

Rumor is Black Rock is starting to accumulate for etf.

Sent from my iPhone using Tapatalk

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

Btc moving

Rumor is Black Rock is starting to accumulate for etf.

Sent from my iPhone using Tapatalk

BlackRock btc etf is IBTC

Sent from my iPhone using Tapatalk

Historybuff

Lil-Rokslider

- Joined

- Jan 28, 2017

- Messages

- 137

Study, buy and hodl bitcoin before the price explodes more. It's not too late to secure generational wealth through bitcoin. Its been my extreme pleasure front running wall street to bitcoin for the last 2 years. Hope some of you have been stacking with me.

Attachments

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

Study, buy and hodl bitcoin before the price explodes more. It's not too late to secure generational wealth through bitcoin. Its been my extreme pleasure front running wall street to bitcoin for the last 2 years. Hope some of you have been stacking with me.

Yep, been adding to my holdings for the last year, really ramped it up in the last 6 months though. Still lots of time to accumulate, but the clock is ticking.

Rumor is the DTCC website removed the BlackRock IBTC ticker and then the site went down. Trying to keep it secret I guess

too late.

too late.Also, all miners and anything related to btc is blowing up today in the market. Some of the miners have been slowly moving up over the last week.

Sent from my iPhone using Tapatalk

Yep, been adding to my holdings for the last year, really ramped it up in the last 6 months though. Still lots of time to accumulate, but the clock is ticking.

Rumor is the DTCC website removed the BlackRock IBTC ticker and then the site went down. Trying to keep it secret I guesstoo late.

Also, all miners and anything related to btc is blowing up today in the market. Some of the miners have been slowly moving up over the last week.

Sent from my iPhone using Tapatalk

It appears that it's possible to buy BTC or Ethereum through Fidelity now. Is there any disadvantage to doing that vs a Crypto Wallet or whatever the other vehicles are?

Seems like people liked cryptocurrencies because they weren't part of the major brokerages?

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

It appears that it's possible to buy BTC or Ethereum through Fidelity now. Is there any disadvantage to doing that vs a Crypto Wallet or whatever the other vehicles are?

Seems like people liked cryptocurrencies because they weren't part of the major brokerages?

I’m also a believer of “not your keys, not your coin” like HenChamp. It would be worth finding out what a withdrawal would look like if you were to purchase on Fidelity. I know on Robin hood there could be a delay to get your crypto out. Even some of the exchanges have a small waiting period.

Like HenChamp stated getting a ledger wallet or a Tezos wallet is the best way to secure your assets bc it is a cold wallet. I also believe in having a hot wallet to send your assets to from the exchange and then from there to your cold wallet. You never make purchases or send crypto directly from your cold wallet without it going through a hot wallet you control. The reasoning for this is you never expose your main cold wallet to any bad actors.

I know guys who keep their crypto on the exchanges and they haven’t had issues. When you start exploring self custody of your crypto it seems confusing at first. After some practice it’s easy and fast. If you go that route only transfer a little the first few times until you get comfortable with it.

And yes I believe in btc bc it can’t be manipulated by inflation. Everyone’s goals are different but I encourage people to get off zero with btc no matter what the amount is.

I have a ton of books I can suggest related to the btc topic and then folks can make educated decisions for themselves and their goals.

Sent from my iPhone using Tapatalk

Yes... it seems confusing... this post is the first I've even heard of hot and cold wallets, etc. Will have to look those up.I’m also a believer of “not your keys, not your coin” like HenChamp. It would be worth finding out what a withdrawal would look like if you were to purchase on Fidelity. I know on Robin hood there could be a delay to get your crypto out. Even some of the exchanges have a small waiting period.

Like HenChamp stated getting a ledger wallet or a Tezos wallet is the best way to secure your assets bc it is a cold wallet. I also believe in having a hot wallet to send your assets to from the exchange and then from there to your cold wallet. You never make purchases or send crypto directly from your cold wallet without it going through a hot wallet you control. The reasoning for this is you never expose your main cold wallet to any bad actors.

I know guys who keep their crypto on the exchanges and they haven’t had issues. When you start exploring self custody of your crypto it seems confusing at first. After some practice it’s easy and fast. If you go that route only transfer a little the first few times until you get comfortable with it.

And yes I believe in btc bc it can’t be manipulated by inflation. Everyone’s goals are different but I encourage people to get off zero with btc no matter what the amount is.

I have a ton of books I can suggest related to the btc topic and then folks can make educated decisions for themselves and their goals.

Sent from my iPhone using Tapatalk

I'm not dropping my life savings or retirement account into crypto, but at this point it does seem like zero is the wrong amount to have. Will look that stuff up and may PM you later to keep from derailing this too far.

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 6,975

Dont worry about derailing. I vote you keep going here so we all can learn.Yes... it seems confusing... this post is the first I've even heard of hot and cold wallets, etc. Will have to look those up.

I'm not dropping my life savings or retirement account into crypto, but at this point it does seem like zero is the wrong amount to have. Will look that stuff up and may PM you later to keep from derailing this too far.

The thread says stocks but the overall theme really is investing.

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

Dont worry about derailing. I vote you keep going here so we all can learn.

The thread says stocks but the overall theme really is investing.

Yep ask away I’m sure there are members who have lots of knowledge to add and learn from.

Sent from my iPhone using Tapatalk

Short version from a few minutes of reading and then looking up what the other terms mean... Lots of questions still but the concept makes a little more sense now. Would be curious what books you recommend although I've got a few in the queue currently.

@MountainTracker or @HenChamp feel free to jump in if I am getting this wrong so far..

A cold wallet is basically like storing your crypto on a USB drive in that even if someone hacks your computer they can't access your USB drive. There's some difference in that it sounds like even if your cold wallet is connected to your computer there is still separation from the internet. No idea how that works but I'll take it at face value.

A hot wallet would be something like coinbase or robinhood that is stored online?

So if I'm understanding right, I create an account on an exchange (coinbase or similar?), then transfer the crypto to a cold wallet?

I haven't made it to how to sell/cash out from a cold wallet yet but I'm assuming you transfer back from your cold wallet to an exchange? Or to your hot wallet then to an exchange?

Is a cold wallet more analogous to cash in that if the bank goes under or the .gov says no more crypto in the US you still have your cash/cold wallet?

@MountainTracker or @HenChamp feel free to jump in if I am getting this wrong so far..

A cold wallet is basically like storing your crypto on a USB drive in that even if someone hacks your computer they can't access your USB drive. There's some difference in that it sounds like even if your cold wallet is connected to your computer there is still separation from the internet. No idea how that works but I'll take it at face value.

A hot wallet would be something like coinbase or robinhood that is stored online?

So if I'm understanding right, I create an account on an exchange (coinbase or similar?), then transfer the crypto to a cold wallet?

I haven't made it to how to sell/cash out from a cold wallet yet but I'm assuming you transfer back from your cold wallet to an exchange? Or to your hot wallet then to an exchange?

Is a cold wallet more analogous to cash in that if the bank goes under or the .gov says no more crypto in the US you still have your cash/cold wallet?

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 814

Short version from a few minutes of reading and then looking up what the other terms mean... Lots of questions still but the concept makes a little more sense now. Would be curious what books you recommend although I've got a few in the queue currently.

@MountainTracker or @HenChamp feel free to jump in if I am getting this wrong so far..

A cold wallet is basically like storing your crypto on a USB drive in that even if someone hacks your computer they can't access your USB drive. There's some difference in that it sounds like even if your cold wallet is connected to your computer there is still separation from the internet. No idea how that works but I'll take it at face value.

A hot wallet would be something like coinbase or robinhood that is stored online?

So if I'm understanding right, I create an account on an exchange (coinbase or similar?), then transfer the crypto to a cold wallet?

I haven't made it to how to sell/cash out from a cold wallet yet but I'm assuming you transfer back from your cold wallet to an exchange? Or to your hot wallet then to an exchange?

Is a cold wallet more analogous to cash in that if the bank goes under or the .gov says no more crypto in the US you still have your cash/cold wallet?

So the cold wallet disconnects your account from the internet and requires you to login to the USB/dongle in order to accept or send crypto on your wallet. You have a separate code you physically put into the usb/dongle so you can grant permission for transactions, this and having the usb/dongle plugged in is what allows your wallet to connect.

Yes a hot wallet is an account on coinbase or any other exchange. Trust wallet is another hot wallet. There are many out there to use. Yes you can transfer from that wallet to your cold wallet. Another layer of security would be to send it to another wallet before your cold.

Since your just learning this I want to make perfectly clear, IF YOU HAVE YOUR SEED PHRASE STOLEN YOU WILL LOSE ALL OF YOUR ASSETS. Sorry not trying to be a d bag but that is very important. Every time you create a wallet whether it’s cold or hot you will get a seed phrase of words any where from 12 to 25. The seed phrase will allow you to rebuild your account at any point on a new wallet. So, if you lost your usb/dongle but still have your seed phrase you can rebuild your wallet with your assets.

If you keep your seed phrase on your computer for your cold wallet and your computer gets hacked, the bad actor can now take all of your assets and transfer them out. Don’t keep your seed phrase on your computer, don’t keep a screen shot of your seed phrase. If you have the ability to setup a 2 Factor Authentication for your wallets I encourage you to do so. Multi layers is how you protect your assets.

When you want to sell you can reverse the order of transaction back to the exchange.

So being your own custodian allows you the ability to control what happens. When FTX collapsed everyone who had assets on their platform/hot wallet had to wait for all kinds of court proceedings to happen before maybe getting anything back. It can take years for that to happen. The other benefit is you can take it everywhere, at the very basic level if you can remember your seed phrase you could in essence rebuild the wallet whenever you want whenever you want.

BTC for me is a way to avoid the inflation tax we are seeing. There will only ever be 21 million btc, and as each halving happens less and less becomes available on the market.

I hope I explained it clearly and didn’t confuse you. If others have points to make please do as I’m always willing to learn myself.

Books:

The Bitcoin Standard

(On YT)

Bitcoin everything divided by 21 million

Bitcoin: Hard money you can’t F*ck with

The Price of Tomorrow

When Money Dies

The Price of Time

The Creature from Jekyll Island

Animal Farm (bc it’s a good book haha)

The Richest Man in Babylon

(Not btc related)

Sent from my iPhone using Tapatalk

bowhiker88

WKR

If I could figure out a decent...by which I mean intelligent and clear about the way to manage risk that leaves aside all the emotional and political BS that I see everywhere (including in this thread)...day trading approach, I would look into it. Until then, I will for the most part keep ahold of my measly ducets.

You gotta decide on what you want in regards to the assets/investments you own (this is just the high level determination), the duration, and level of active management to name a few. You also need to have grounded beliefs regarding investing and the various ways to approach it. There’s a lot of ways to make money but that doesn’t mean they will all work for you.

I recommend to most people who are interested in stocks but don’t know what fundamental research, stock selection, portfolio construction/management, looks like at the professional level, to focus on some of the bigger names in the US across each sector except energy, utilities, and financials and then pick 5-10 per sector and then do some research and narrow it down to 5 names per sector and build a portfolio of stocks that way.

Essentially you’re making a custom index or benchmark hugging. All mutual fund managers do it. You won’t get great alpha but hopefully some. At the end of the day I don’t particularly think this is a great way to use your time since the alpha isn’t going to be significant. Stock picking is the best way to generate alpha and it needs to be done on the short and long side. If anything I’d spend time learning how to short stocks because you can use that as a skill when markets are weak and youre watching your longs bleed out slowly each day

Marshfly

WKR

You gotta decide on what you want in regards to the assets/investments you own (this is just the high level determination), the duration, and level of active management to name a few. You also need to have grounded beliefs regarding investing and the various ways to approach it. There’s a lot of ways to make money but that doesn’t mean they will all work for you.

I recommend to most people who are interested in stocks but don’t know what fundamental research, stock selection, portfolio construction/management, looks like at the professional level, to focus on some of the bigger names in the US across each sector except energy, utilities, and financials and then pick 5-10 per sector and then do some research and narrow it down to 5 names per sector and build a portfolio of stocks that way.

Essentially you’re making a custom index or benchmark hugging. All mutual fund managers do it. You won’t get great alpha but hopefully some. At the end of the day I don’t particularly think this is a great way to use your time since the alpha isn’t going to be significant. Stock picking is the best way to generate alpha and it needs to be done on the short and long side. If anything I’d spend time learning how to short stocks because you can use that as a skill when markets are weak and youre watching your longs bleed out slowly each day

This is great advice. Shorting but also options as hedges. The markets don’t always go up and negating the drawdowns even a little will significantly increase long term returns.

Sent from my iPhone using Tapatalk

bowhiker88

WKR

The reason people don’t make money over the long term in and are recommended to see professionals is because when the market or down 10% in one week, no one who is a retail investor has the ability to not look at their losses and hold onto their positions they also and then what happens is the stock rip back up they don’t have capital to buy

bowhiker88

WKR

If you only owned stocks, And you don’t short any stocks and your portfolio is higher beta than the S&P when the market is down 5% or 10% in a week like what happened in 2020 there’s a small percentage of non-professional investors who can sit back and say I need to have discipline I need to not sell that’s when knowing the businesses you own is critical because if you don’t know what’s in your portfolio, you don’t know what can potentially hurt the fundamentals of that business so if you owned software stocks in 2020 in the beginning of the year And you took the time to say hey these stocks are actually gonna benefit and not be impacted by Covid or by people not going out in public then you would’ve bought more but when they dropped 20% right away you didn’t know what was going on you probably would’ve sold.

There is no easy way to make money in the markets. Anyone who’s tells you this is lying. If it was so easy then everyone would be running a hedge fund or putting up double digit returns every year making millions.

The only way to do it consistently over long term through different market cycles and economic cycles is through diligent fundamental research. Buying businesses for less than they’re worth at a time when sentiment around fundamentals and your view on future fundamentals are at the largest divergence. This happens when catalysts are nearing and the valuation gap is at a turning point and the stock is ripe. How do you find stocks like this or set ups like this? Well that’s the hard part, no forum will tell you how. I promise you that.

There is no easy way to make money in the markets. Anyone who’s tells you this is lying. If it was so easy then everyone would be running a hedge fund or putting up double digit returns every year making millions.

The only way to do it consistently over long term through different market cycles and economic cycles is through diligent fundamental research. Buying businesses for less than they’re worth at a time when sentiment around fundamentals and your view on future fundamentals are at the largest divergence. This happens when catalysts are nearing and the valuation gap is at a turning point and the stock is ripe. How do you find stocks like this or set ups like this? Well that’s the hard part, no forum will tell you how. I promise you that.

Similar threads

- Replies

- 1K

- Views

- 79K

Featured Video

Stats

Latest Articles

-

TT#31 Hunting Big Bull Elk In New Zealand’s Fiordland National Park

-

Hunting the Biggest Mule Deer on the Continent with Cody Robbins

-

T&K Hunting Gear Gaiter Review

-

The Highway and Mule Deer With UDOT’s Matt Howard

-

Argali Talus Review

-

Among the Old Oaks and Fallow Deer

-

Hunting Big Mule Deer: Ambush Hunting

-

TT#30 Bow Tuning with Daykota Kime and the Cold Bow Challenge

-

What Winning Looks Like, with Dan Gates

-

Maven S.3A Spotting Scope Review