Johnboy

WKR

- Joined

- Dec 12, 2014

- Messages

- 539

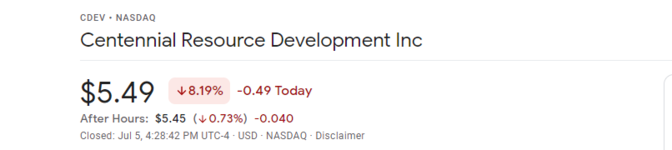

@Broomd, what's your crystal ball telling you about the tug-of-war between general economic sentiment and crude oil ticking back up? Who wins in the near term, say by beginning of fall? Disclosure: my trade account hemorrhaged 25% since a month ago, mostly due to oil. That one stings a bit!